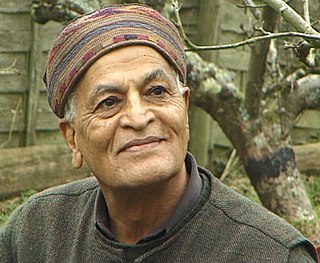

A Quote by Noam Chomsky

The times are too difficult and the crisis too severe to indulge in schadenfreude. Looking at it in perspective, the fact that there would be a financial crisis was perfectly predictable: its general nature, if not its magnitude. Markets are always inefficient.

Related Quotes

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.