A Quote by Noam Chomsky

A big producer can survive price fluctuations on the world market. A small farmer can't.

Related Quotes

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

Big meetings and big talk are not enough in a world that is hungry for change. Big action - world leaders keeping their promises, and developing countries committing resources while listening ardently to the voice of the small farmer - is needed to bring big results and prosperity to the world's poor.

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks.

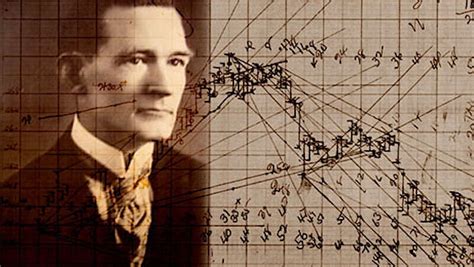

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands. By having confidence in their own analysis and judgement, they respond to market forces not with blind emotion but with calculated reason. Successful investors, for example, demonstrate caution in frothy markets and steadfast conviction in panicky ones. Indeed, the very way an investor views the market and it’s price fluctuations is a key factor in his or her ultimate investment success or failure.