A Quote by Noam Chomsky

Before the 1970s, banks were banks. They did what banks were supposed to do in a state capitalist economy: they took unused funds from your bank account, for example, and transferred them to some potentially useful purpose like helping a family buy a home or send a kid to college.

Related Quotes

The expansionary operations of the Second Bank of the United States, coupled with its laxity toward insisting on specie payment by the state banks, impelled a further inflationary expansion of state banks on top of the spectacular enlargement of the central bank. Thus, the number of incorporated state banks rose from 232 in 1816 to 338 in 1818.

Banks don't want certain asset classes, and that's created opportunities for private equity, hedge funds, Silicon Valley. In this case I think he was referring to some of the European banks shedding assets, and the big buyers are probably not going to be big American banks. Someone like Blackstone may have a very good chance to buy those assets, leverage them, borrow up a little bit, and do something good there.

The Central Bank should have a permanent window for discounting high quality securities where banks could go and discount these. It gives peace of mind to the banks. In the absence of this facility, what banks tend to do is to keep a liquidity cushion for emergency requirements. This is a very expensive way of managing liquidity.

My guess is the big Chinese banks will be in 100?countries by then. They will have very sophisticated operations, and they may very well have bought banks around the world in countries that allow it. I mean, I don't think the American government would allow them to buy JPMorgan. But they will be able to buy a sizable big bank in the U.S. at some point. Whether they do or not, or if it's allowed or not, I don't know.

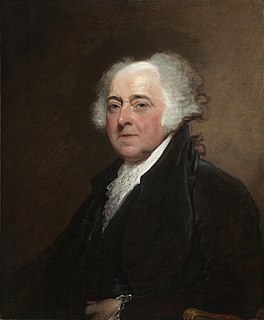

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

Under Bill Clinton's HUD Secretary Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in 'credit-deprived' areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.