A Quote by Noam Chomsky

The Latin American debt that reached crisis levels from 1982 would have been sharply reduced by return of flight capital - in some cases, overcome, though all figures are dubious for these secret and often illegal operations.

Related Quotes

One of the issues with some of these lenders is going to be, where will their provider of credit be when there's a crisis? That's why some of these smarter services, to support their operations, are courting more permanent capital. They want a source of longer-term funding that can survive a crisis.

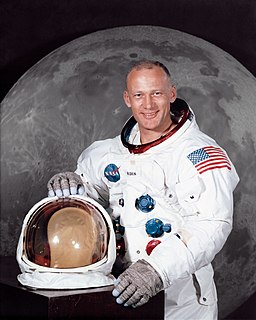

Everyone who's been in space would, I'm sure, welcome the opportunity for a return to the exhilarating experiences there. For me, a flight in a shuttle, though most satisfying, would be anticlimactic after my flight to the moon. Plus, if I pursued a flight myself, people would think that was the reason I am trying to generate interest in public spaceflight. And that's not the purpose - I want to generate interest in long-range space exploration.

The term blowback, which officials of the Central Intelligent Agency first invented for their own internal use, . . . refers to the unintended consequences of policies that were kept secret from the American people. What the daily press reports as the malign act of terrorists or drug lords or rogue states or illegal arms merchants often turn out to be blowback from earlier American operations.

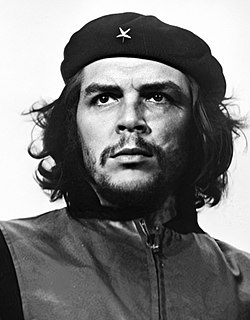

If it is an element of liberation for Latin America, I believe that it should have demonstrated that. Until now, I have not been aware of any such demonstration. The IMF performs an entirely different function: precisely that of ensuring that capital based outside of Latin America controls all of Latin America.

Nothing exceptional [would happen to the world under a Hillary Clinton's presidency] - things would stay the same: sponsorship of "Color" or "Umbrella" or whatever "revolutions", some more coups, "regime changes", direct invasions, bombing, propaganda warfare against China, Russia, Iran, South Africa and what is left of the Latin American revolutions. There would be plenty of torture in "secret centers", but it would not be as advertised and glorified as it would be if [Donald] Trump were elected.

Obviously, consideration of costs is key, including opportunity costs. Of course capital isn't free. It's easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you're generating a 100% return on capital, then you shouldn't invest in something that generates an 80% return on capital. It's crazy.

The moment a large investor doesn't believe a government will pay back its debt when it says it will, a crisis of confidence could develop. Investors have scant patience for the years of good governance - politically fraught fiscal restructuring, austerity and debt rescheduling - it takes to defuse a sovereign-debt crisis.

Some persons can give themselves away to an ambitious pursuit and have that be all the giving-themselves-away-to-something they need to do. Though sometimes this changes as the players get older and the pursuit more stress-fraught. American experience seems to suggest that people are virtually unlimited in their need to give themselves away, on various levels. Some just prefer to do it in secret.