A Quote by Nouriel Roubini

No country can be complacent in making sure that excessive debt of the household doesn't create excesses and weaknesses in the financial system. Everything is interconnected.

Related Quotes

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.

We have to get back to a government where leaders are willing to talk across party lines and do not have absolute politics as the goal. Our goal has to be bettering the country, making sure we have an education system that is world-class and a healthcare system that is world-class, making sure social security is safe. People don't care who is huddling in a corner with whom, making the next political move. If you are elected to do a job, you are supposed to do it to the best of your ability.

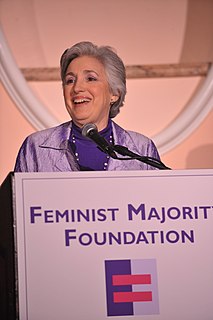

She [Carolyn Maloney] understands the whole picture. She is comfortable with these issues 'cause she is chair of the committee, and she's dogged and will make sure the average woman and man is represented as well as making sure that our financial system stays afloat. In other words, she gets it and she has represented the financial district, but she also represents the average person and definitely the average woman.

The Fed needs to adopt new tools, on its own and perhaps in cooperation with the other parts of the US government, to improve the economy from the bottom up. This includes increasing facilities for debt forgiveness for under-water mortgages and excessive student loans; increased credit facilities for small businesses and cooperatives; helping to underwrite mechanisms for creating affordable housing in cities; and more restrictive enforcement of financial regulatory rules to help rein in excessive banker risk and pay.