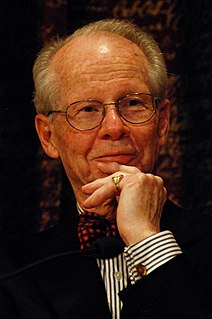

A Quote by Oliver E. Williamson

The transaction cost approach maintains that some projects are easy to finance by debt and ought to be financed by debt. These are projects for which physical-asset specificity is low to moderate.

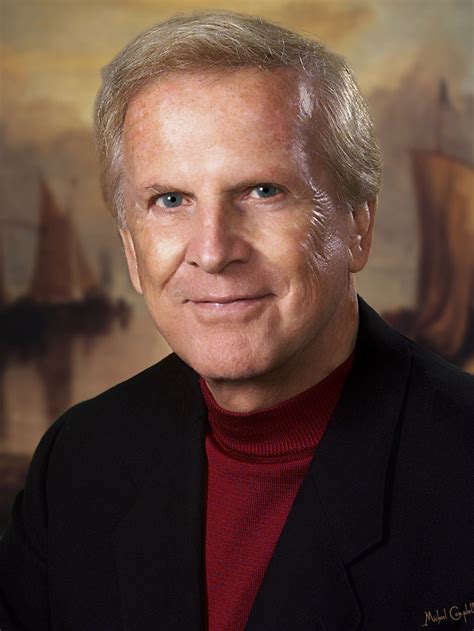

Related Quotes

The companies that provide debt, what do you think their goal is? Is their goal for you to fully understand the cost of your debt? No. So they're basically creating these approaches to make you feel like it is incredibly cheap or just to think about the cost per day rather the cost per year or cost for a lifetime. So debt is very simple mistake.

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

The first set of questions to ask yourself when you're doing cost cutting is relatively straightforward, which is, you know, can you use the necessity of cost cutting as an opportunity to do pruning or trimming for projects that aren't being as successful? But, you know, frequently those are the easy ones. I mean, there's always some kind of social costs internal to the company, but that's the easy way of looking at the future.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.