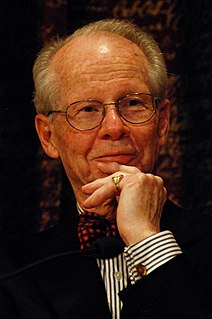

A Quote by Oliver E. Williamson

Vertical intergration is an organizational response to the contracting difficulties that attend intermediate product markets where trades that are supported by transaction-specific assets are exposed to hazard.

Related Quotes

"Free markets" is a very general term. There are all sorts of problems that will emerge. Free markets work best when the transaction between two individuals affects only those individuals. Most often, a transaction between you and me affects a third party. That is the source of all problems for government. That is the source of all pollution problems, of the inequality problem. This reality ensures that the end of history will never come.

The ritual of exorcism is not practiced by an ordinary priest. An exorcist requires specific training and must be thought to have a personal sanctity. He can be exposed to dangerous behavior and personal threat. His prayers often cause a violent response as he attempts to shine a beam of light into the darkness.

Unlike national markets, which tend to be supported by domestic regulatory and political institutions, global markets are only 'weakly embedded'. There is no global lender of last resort, no global safety net, and of course, no global democracy. In other words, global markets suffer from weak governance, and are therefore prone to instability, inefficiency, and weak popular legitimacy.

Society is purely and solely a continual series of exchanges... And the greatest eulogy we can give it, for exchange is an admirable transaction, in which two contracting parties always both gain; consequently, society is an uninterrupted succession of advantages, unceasingly renewed for all its members.

Like its agriculture, Africa's markets are highly under-capitalized and inefficient. We know from our work around the continent that transaction costs of reaching the market, and the risks of transacting in rural, agriculture markets, are extremely high. In fact, only one third of agricultural output produced in Africa even reaches the market.

What does reflect reality very well is complexity theory, which comes from physics. I'm the one pioneering the idea of bringing it to capital markets. When you look at capital markets through the lens of complexity theory, you ask "what's the scale of the system?" Scale is a fancy word for size. What measures are you using? If you look at total debt, the concentration of assets in the five largest banks, what percentage of the total assets of the five largest banks are interconnected? What you see is a very densely connected, fragile system that could collapse at any moment.

Look at the word responsibility-"response-ability"-the ability to choose your response. Highly proactive people recognize that responsibility. They do not blame circumstances, conditions, or conditioning for their behavior. Their behavior is a product of their own conscious choice, based on values, rather than a product of their conditions, based on feeling.