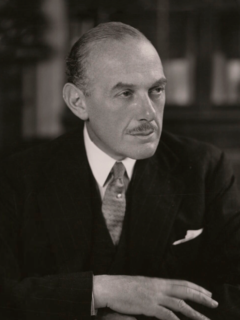

A Quote by Oliver Lyttelton, 1st Viscount Chandos

In business a reputation for keeping absolutely to the letter and spirit of an agreement, even when it is unfavorable, is the most precious of assets, although it is not entered in the balance sheet.

Related Quotes

A man's reputation is not in his own keeping, but lies at the mercy of the profligacy of others. Calumny requires no proof. The throwing out [of] malicious imputations against any character leaves a stain, which no after-refutation can wipe out. To create an unfavorable impression, it is not necessary that certain things should be true, but that they have been said. The imagination is of so delicate a texture that even words wound it.

If you look at the balance sheet, the US is heavily in debt. If you look at the income account - the amount of interest the US pays abroad - it is almost exactly equal to the amount of interest that it receives from abroad. American assets held abroad are earning a higher rate of return than foreign assets held here.

Most people think of the economy as producing goods and services and paying labor to buy what it produces. But a growing part of the economy in every country has been the Finance, Insurance and Real Estate (FIRE) sector, which comprises the rent and interest paid to the economy's balance sheet of assets by debtors and rent payers.

To minimize market uncertainty and achieve the maximum effect of its policies, the Federal Reserve is committed to providing the public as much information as possible about the uses of its balance sheet, plans regarding future uses of its balance sheet, and the criteria on which the relevant decisions are based.