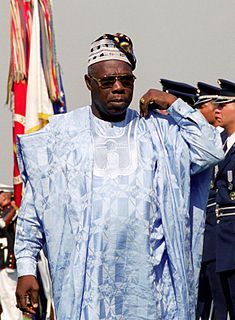

A Quote by Olusegun Obasanjo

What the oil producer gets paid is about 16 percent. The majority of it is tax, which in fairness to the government of this country they have accepted and admitted.

Related Quotes

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

We've been prepared to make the arguments for lowering corporation tax, which is all about encouraging risk takers, encouraging entrepreneurs, and I observe that for the vast majority of the Labour government we had a top rate of 40 per cent income tax. It's now higher, and I think we should look to get to a simpler, lower tax system.

[In Mexico] they have a VAT tax. We're on a different system. When we sell into Mexico, there's a tax. When they sell in - automatic, 16 percent, approximately. When they sell into us, there's no tax. It's a defective agreement. It's been defective for a long time, many years, but the politicians haven't done anything about it.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

We're bringing the corporate rate down to 20 percent from 35 percent. That's a massive - this will be the biggest tax cut in history. In the history of our country. And that's great. And we need it. Because right now, our country's about the highest taxed or certainly one of the highest taxed in the world. And we can't have that. So we're going to have a country that's toward the lower end.

In 1990, about 1 percent of American corporate profits were taken in tax havens like the Cayman Islands. By 2002, it was up to 17 percent, and it'll be up to 20-25 percent very quickly. It's a major problem. Fundamentally, we have a tax system designed for a national, industrial, wage economy, which is what we had in the early 1900s. We now live in a global, asset-based, services world. And we need to have a tax system that follows the economic order or it's going to interfere with economic growth, it's going to reduce people's incomes, and it's going to damage the US.