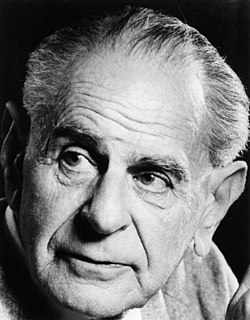

A Quote by Owen Arthur

Those of us who understand human history know the role taxation has played in shaping the destiny of mankind. The matter of taxes - more specifically, the right to tax - is clearly no stranger to controversy and has frequently served as the catalyst for revolutionary change.

Related Quotes

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

I decided that if nobody else was going to do anything to rectify this colossal inequity in taxation, I'd have to do it myself. So I instituted a suit against the city of Baltimore demanding that the city assessor be specifically ordered to assess the Church for its vast property holdings in the city, and that the city tax collector then be instructed to collect the taxes once the assessment has been made.

Every presidential candidate for decades has released his tax returns, and I've released 33 years of my tax returns. The American people deserve to know about our taxes. And so Donald Trump is standing in the way of precedent that goes back on both sides of aisle Democrats and Republicans, and he clearly has something that he doesn't want us to see.

No, it’s very comforting actually, to know that you’re sitting in a long legacy of actresses who’ve played the role. I’m absolutely all for absorbing all of those influences, so you understand the pedigree of the part as much as you understand the figure in history… because you are playing the part. You don’t say: “Gosh, I want to play Peter Sellers…” because you can sort of do that in your own bathroom.

The churches rose to power on the income from tax-free property. What earthly -or heavenly- right have they got to enjoy a privilege denied to everyone else, even including nonprofit organizations? None! My contention is that with the churches exempted from property taxation, you and I have to pay that much more in taxes to make up for what they're not contributing.

The history of science, like the history of all human ideas, is a history of irresponsible dreams, of obstinacy, and of error. But science is one of the very few human activities-perhaps the only one-in which errors are systematically criticized and fairly often, in time, corrected. This is why we can say that, in science, we often learn from our mistakes, and why we can speak clearly and sensibly about making progress there. In most other fields of human endeavour there is change, but rarely progress ... And in most fields we do not even know how to evaluate change.

China is incredibly important to the future of mankind. For me, this is something that we all need to have intelligent discussions about in America, in Britain, in Europe. We need to really understand that their destiny and our destiny, Africa's destiny, etc., are all completely tied in. The argument for getting to know your neighbors is very compelling.