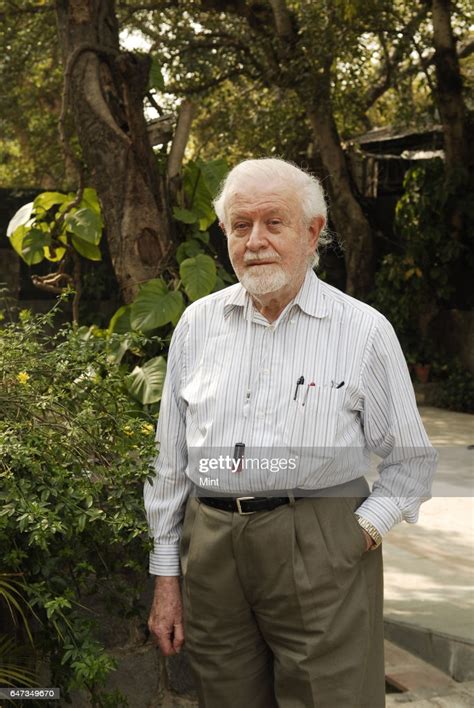

A Quote by Owen Jones

We need global tax justice, not charitable scraps dictated by the fancies of the elite.

Related Quotes

Charity is commendable; everyone should be charitable. But justice aims to create a social order in which, if individuals choose not to be charitable, people still don't go hungry, unschooled or sick without care. Charity depends on the vicissitudes of whim and personal wealth; justice depends on commitment instead of circumstance.

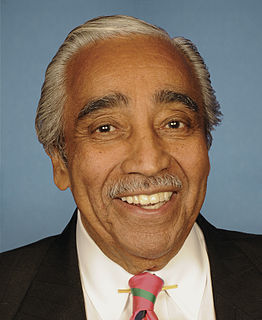

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

I think the Ronald Reagan tax reform proposals are a step toward distributive justice. They redistribute the tax burden more equitably and more progressively among individuals and call upon business to carry a somewhat larger proportion of the total tax load. Both of these are steps toward equity and distributive justice.

Global warming is a justice issue. It's a justice issue because global warming is theft - theft from our own children and grand children, of their right to a livable future. It's a justice issue, because its victims are, and will be, disproportionately poor and of color, those least able to contend with or to flee, the storms, droughts, famines, and rising tides of global warming.

The charitable say in effect, 'I seem to have more than I need and you seem to have less than you need. I would like to share my excess with you.' Fine, if my excess is tangible, money or goods, and fine if not, for I learned that to be charitable with gestures and words can bring enormous joy and repair injured feelings.