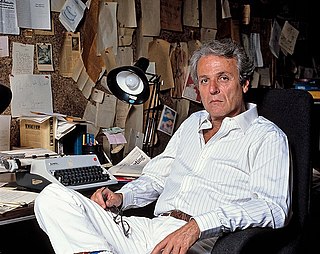

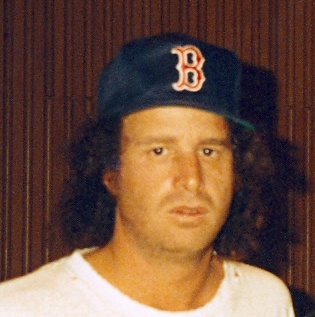

A Quote by P. J. O'Rourke

Remember that all tax revenue is the result of holding a gun to somebody's head. Not paying taxes is against the law. If you don't pay your taxes, you'll be fined. If you don't pay the fine, you'll be jailed. If you try to escape from jail, you'll be shot. ... Therefore, every time the government spends money on anything, you have to ask yourself, 'Would I kill my kindly, gray-haired mother for this?'

Related Quotes

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

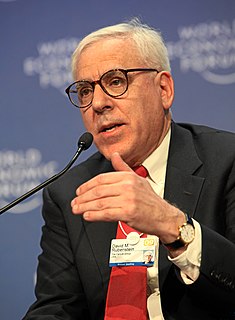

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

Multi-millionaires who pay half or less than half of the percentage of tax the rest of us pay justify their actions by saying they pay what the law requires. Though true, the fact is they found ways within the law to beat the purpose of the law - which, in the case of taxes, is that we all pay our fair share.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.

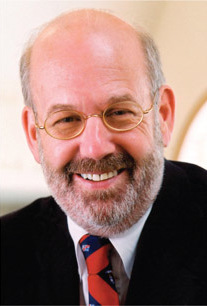

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

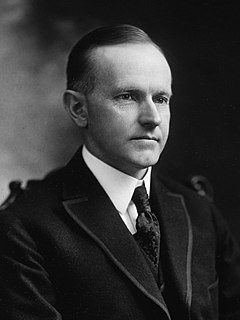

No matter what anyone may say about making the rich and the corporations pay the taxes, in the end they come out of the people who toil. It is your fellow workers who are ordered to work for the Government, every time an appropriation bill is passed. The people pay the expense of government, often many times over, in the increased cost of living. I want taxes to be less, that the people may have more.

The theory of government I was taught says that government provides benefits, primarily security, to the entire population. In return we pay taxes. But lately the government has been a distributor of special privileges, taking money from some and giving it to others. America is now about evenly split between those who pay income taxes and those who consume them.