A Quote by Parker Conrad

I tried paying at a restaurant with stock options. It didn't work.

Quote Topics

Related Quotes

We can think about how we reduce the pain in paying. So, for example, credit cards are wonderful mechanisms to reduce the pain of paying. If you go to a restaurant and you are paying cash, you would feel much worse than if you were paying with credit card. Why? You know the price, there's no surprise, but if you're paying cash, you feel a bit more guilt.

Common hedging techniques include shorting stocks, buying put options, writing call options, and various types of leverage and paired transactions. While I do reserve the right to use these tools if and when appropriate, my firm opinion is that the best hedge is buying an appropriately safe and cheap stock.

If bankers can push the loans and make more profits for the bank, they get paid higher bonuses. They often also get stock options. If the bank goes under, they get to keep all of these salaries and options - and the government will bail out the bank. These guys will take their money and run, which is pretty much what they're doing now.

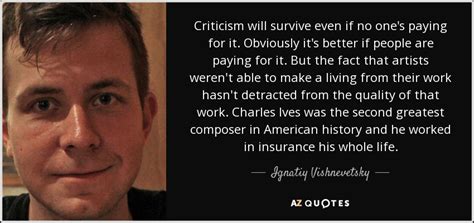

Criticism will survive even if no one's paying for it. Obviously it's better if people are paying for it. But the fact that artists weren't able to make a living from their work hasn't detracted from the quality of that work. Charles Ives was the second greatest composer in American history and he worked in insurance his whole life.