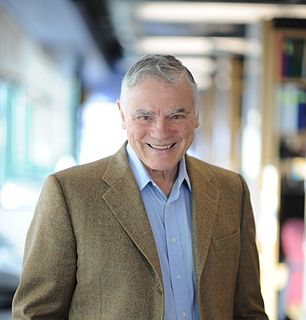

A Quote by Patch Adams

If you actually are a doctor and admitted it, you'd say, 'I don't cure a huge percentage, I don't have a 50 percent cure rate ... but I can have a 100 percent compassion rate'.

Quote Topics

Related Quotes

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

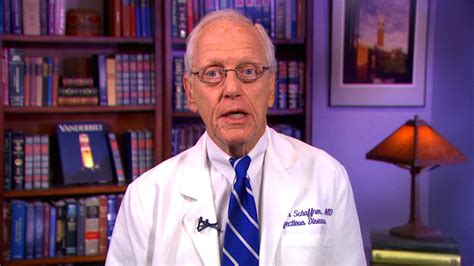

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

The black unemployment rate has to be twice that of the white rate in the US. If the national unemployment rate were 6.8 percent, everyone would be freaking out. We ought to not take too much solace in the 6.8 percent, but ask ourselves what can we do to bring that down to white rates, which are below 4 percent now. Some of that has to do with education, but that's just part of the story. You find that those unemployment differentials persist across every education level. I think it means pushing back on discrimination and helping people who can't find work get into the job market.

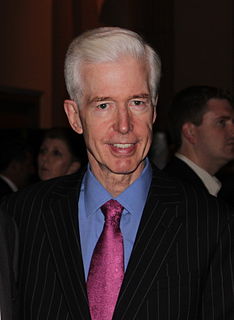

Up until 1986, the top marginal rate, the top statutory rate was 50 percent. Now it's 35 percent. And all the pressure is on to lower that even further. And this just doesn't make a great deal of sense. When people say, 'Oh, we can't raise taxes on the rich. They'll go on strike, they'll move to another country.' But within recent memory, it hasn't been that long ago that we had rates that were substantially higher. And these people did just fine. I just think that there's a disconnect between the facts of what taxes do and the sort of mythology of what they do.