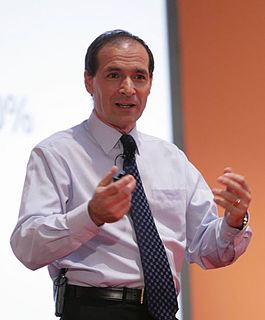

A Quote by Patrick Dixon

In banking or insurance trust is the only thing you have to sell.

Related Quotes

Unemployment insurance, abolishing child labor, the 40-hour work week, collective bargaining, strong banking regulations, deposit insurance, and job programs that put millions of people to work were all described, in one way or another, as 'socialist.' Yet, these programs have become the fabric of our nation and the foundation of the middle class.

I've got to say our banking system is a safe and a sound one. And since the days when we've had federal deposit insurance in place, we haven't had a depositor who's got less than $100,000 in an account lose a penny. So the American people can be very, very confident about their accounts in our banking system.

Innovation has stalled in the banking industry. While the rest of the world is in the digital age, banking remains stagnant. We are here to change this and bring banking to the 21st century. We will ensure our customers feel involved in the progress of this bank and are offering them a truly enjoyable banking experience – different from anything they have experienced before.