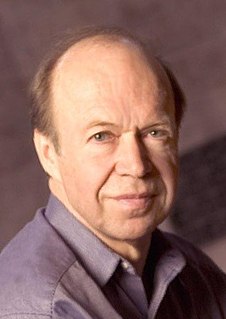

A Quote by Patrick M. Byrne

Over the next decade, there will be disruption as significant as the Internet was for publishing, where blockchain is going to disrupt dozens of industries, one being capital markets and Wall Street.

Related Quotes

I think the money for the solutions for global poverty is on Wall Street. Wall Street allocates capital. And we need to get capital to the ideas that are successful, whether it's microfinance, whether it's through financial literacy programs, Wall Street can be the engine that makes capital get to the people who need it.

In a world with many blockchains and hundreds of tradable tokens built on top of them, entire industries are automated through software, venture capital and stock markets are circumvented, entrepreneurship is streamlined, and networks gain sovereignty through their own digital currency. This is the next phase of the Internet.

Over the objections, where they sound like squealing pigs, over the objections of Romney and all his allies, we passed some of the toughest Wall Street regulations in history, turning Wall Street back into the allocator of capital it always has been and no longer a casino. And they want to repeal it.

More and more major industries are being run on software and delivered as online services—from movies to agriculture to national defense. Many of the winners are Silicon Valley-style entrepreneurial technology companies that are invading and overturning established industry structures. Over the next 10 years, I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.