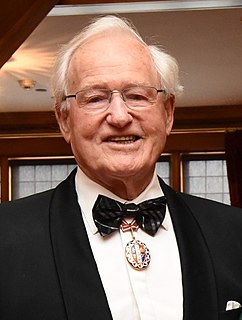

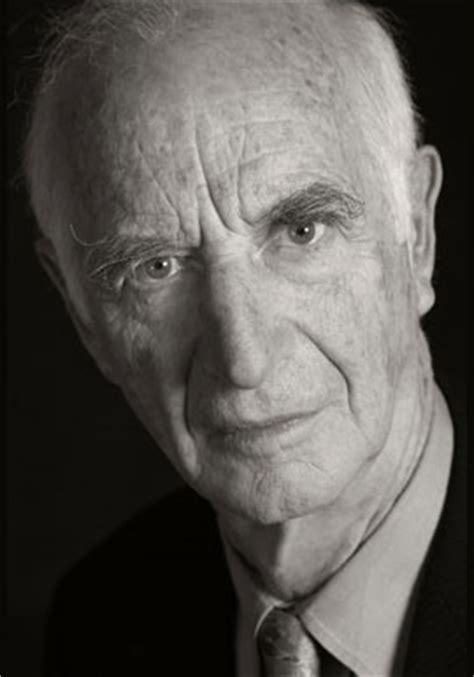

A Quote by Paul Bloom

We benefit, intellectually and personally, from the interplay between different selves, from the balance between long-term contemplation and short-term impulse. We should be wary about tipping the scales too far. The community of selves shouldn't be a democracy, but it shouldn't be a dictatorship, either.

Related Quotes

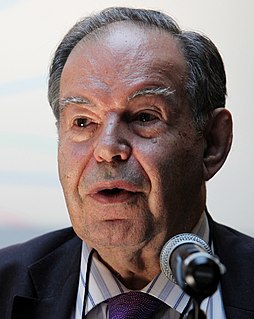

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

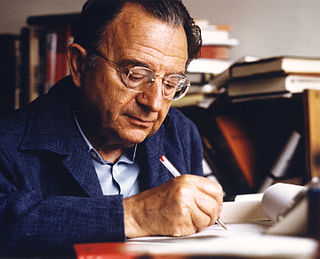

My position is that the rate should align with the level of economic development. Because it is always about a balance, a balance of interests, and it should reflect this balance. A balance between those who sell something across the border and those who benefit from a low rate, as well as a balance between the interests of those who buy, who need the rate to be higher. A balance between national producers, for example, agricultural producers who are interested in it.