A Quote by Paul Broun

It's absolutely critical that we audit the Fed so the American people can see what's going on over there. Do it from top to bottom so that we can have transparency in this entity called the Federal Reserve. Hopefully, the American people will see that we need to go back to the gold standard, which I've introduced, and get rid of the Fed.

Related Quotes

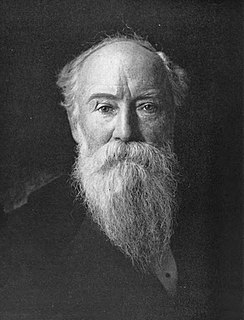

Some people think the Federal Reserve Banks are US government institutions. They are not... they are private credit monopolies which prey upon the people of the US for the benefit of themselves and their foreign and domestic swindlers, and rich and predatory money lenders. The sack of the United States by the Fed is the greatest crime in history. Every effort has been made by the Fed to conceal its powers, but the truth is the Fed has usurped the government. It controls everything here and it controls all our foreign relations. It makes and breaks governments at will.

People in America get really angry at the Federal Reserve and at the "money system" in general during economic crises. The Fed draws hostility because of its power, its insulation from democratic accountability, its lack of transparency, and because of its historical and structural connections to finance.

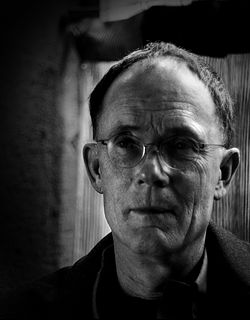

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.

When the Federal Reserve Act was passed, the people of these United States did not perceive that a world banking system was being set up here. A super-state controlled by international bankers and international industrialists acting together to enslave the world for their own pleasure. Every effort has been made by the Fed to conceal its powers but the truth is - The Fed has usurped the government!!

Hyperinflation is not going to happen in this country, will never happen... The Fed putting so much money into the system is not going to create the risk of hyperinflation in the future. We have a strong independent Federal Reserve with a very strong mandate from the Congress, and they will do what's necessary to keep inflation low and stable over time.

I think we're so addicted to bubble finance at the Fed that they can't get out of the corner they painted themselves into. I think the Fed is making federal debt so cheap that Congress has no interest, Washington has no incentive to ever face up to our massive fiscal gap that is going to grow, and grow as we go forward in time and so we have a paralyzed system.

What we need to do is to have a sensible approach to immigration. It needs to be open. It needs to be non-dogmatic and non-bigoted. We need to be firm but reasonable in the way we deal with the problem of illegal immigration. And we need to try to get as many of our immigrants who want to do so to become citizens as quickly as possible so that the American people will all see that this is a part of the process of American history, which is a good one for our country.