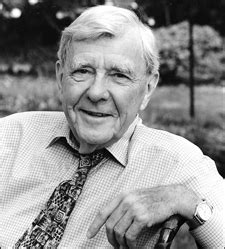

A Quote by Paul Craig Roberts

Corporations and Wall Street in pursuit of short-term profits have given the economy away.

Quote Topics

Related Quotes

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

Only by transforming our own economy to one of peace can we make possible economic democracy in the Third World or our own country. The present economy generates wars to protect its profits and its short-term interests, while squandering the future. Unless we transform the economy, we cannot end war.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

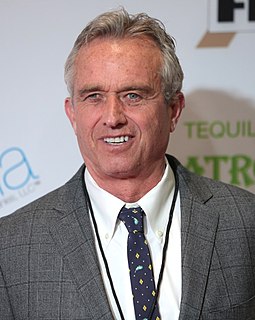

Corporations are a good thing. But corporations should not be running our government... They have driven the American economy since its founding, and the prosperity of our country is largely dependent on the free operation of corporations. But some corporations don't want free markets, and they don't want democracy. They want profits.