A Quote by Paul Farmer

Equity is the only acceptable goal

Quote Topics

Related Quotes

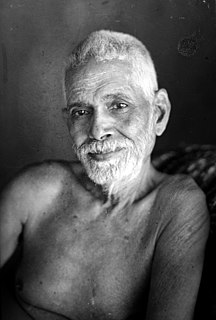

Yogas chitta vritti nirodhah - (Yoga is to check the mind from changing) - which is acceptable to all. That is also the goal of all. The method is chosen according to one's own fitness. The goal for all is the same. Yet different names are given to the goal only to suit the process preliminary to reaching the goal. Bhakti, Yoga, Jnana are all the same.

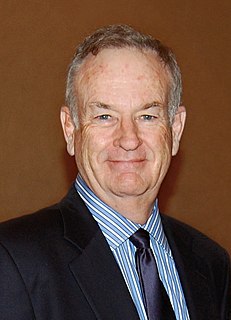

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.

Now, suppose that a homeowner puts down only 3% of their own money or 3.5% for the FHA. That means if prices go down by only 3%, the house will be in negative equity and it would pay the homeowner just to walk away and say, "The house now is worth less than the mortgage I owe. I think I'm just going to move out and buy a cheaper house." So it's very risky when you have only a 3% or 3.5% equity for the loan. The bank really isn't left with much cushion as collateral.

Most startup entrepreneurs unnecessarily spend half their time and give up half their equity in search of funding from angel investors and venture capitalists. Tens of millions of dollars are available to them for free from partners who not only don't want their equity, they don't even want to be paid back.

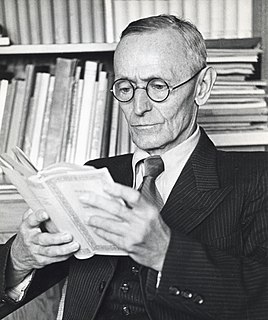

When someone is seeking, it happens quite easily that he only sees the thing that he is seeking; that he is unable to find anything, unable to absorb anything, because he is only thinking of the thing he is seeking, because he has a goal, because he is obsessed with his goal. Seeking means: to have a goal; but finding means: to be free, to be receptive, to have no goal. You, O worthy one, are perhaps indeed a seeker, for in striving towards your goal, you do not see many things that are under your nose.