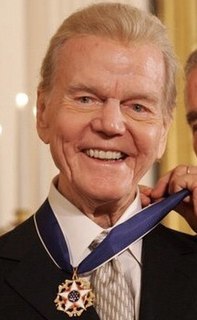

A Quote by Paul Harvey

When your outgo exceeds your income, the upshot may be your downfall.

Related Quotes

May God guide you on this path. May you understand that you are blessed children and you have a job to do. May you know in your heart that God belongs to you always, within and without. May your sorrows never touch your tomorrow, may your blessings be for all, may your happiness be shared, and may your smiles give hope to others.

What starting your company means: you will lose your stable income, your right to apply for a leave of absence, and your right to get a bonus. However, it also means your income will no longer be limited, you will use your time more effectively, and you will no longer need to beg for favours from people anymore.

Your income is a direct reward for the quality and quantity of the services you render to your world. Whatever field you are in, if you want to double your income, you simply have to double the quality and quantity of what you do for that income. Or you have to change activities and occupations so that what you are doing is worth twice as much.

It must be emphasized that as a father, you are always teaching. For good or ill your family learns your ways, your beliefs, your heart, your ideas, your concerns. Your children may or may not choose to follow you, but the example you give is the greatest light you hold before your children, and you are accountable for that light.

Remember life insurance is intended as income replacement to help dependents and or/spouse pay for things that your income would have covered. When you get to the point that you're dependents (Your kids mostly) aren't dependent on your income, you could reduce the amount of life insurance you are carrying.

I ... express a wish that you may, in your generation, be fit to compare to a candle; that you may, like it, shine as lights to those about you; that, in all your actions, you may justify the beauty of the taper by making your deeds honourable and effectual in the discharge of your duty to your fellow-men.

Get a notebook, my young folks, a journal that will last through all time, and maybe the angels may quote from it for eternity. Begin today and write in it your goings and comings, your deepest thoughts, your achievements and your failures, your associations and your triumphs, your impressions and your testimonies.