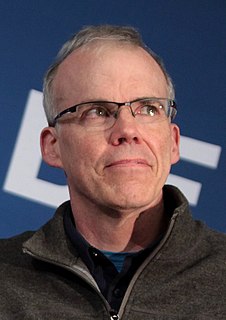

A Quote by Paul Hawken

Throughout the industrial era, economists considered manufactured capital - money, factories, etc. - the principal factor in industrial production, and perceived natural capital as a marginal contributor. The exclusion of natural capital from balance sheets was an understandable omission. There was so much of it, it didn't seem worth counting.

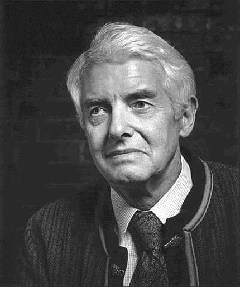

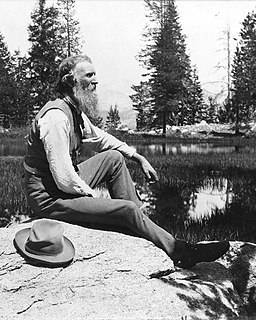

Related Quotes

The information revolution has changed people's perception of wealth. We originally said that land was wealth. Then we thought it was industrial production. Now we realize it's intellectual capital. The market is showing us that intellectual capital is far more important that money. This is a major change in the way the world works. the same thing that happened to the farmers during the Industrial Revolution is now happening to people in industry as we move into the information age.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

I shall argue that it is the capital stock from which we derive satisfaction, not from the additions to it (production) or the subtractions from it (consumption): that consumption, far from being a desideratum, is a deplorable property of the capital stock which necessitates the equally deplorable activity of production: and that the objective of economic policy should not be to maximize consumption or production, but rather to minimize it, i.e. to enable us to maintain our capital stock with as little consumption or production as possible.