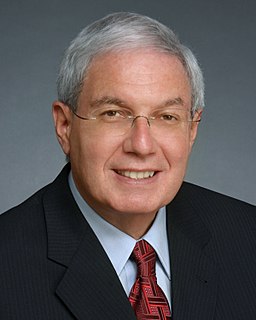

A Quote by Paul Hawken

The financial capital is being concentrated by corporations, institutional investors, and even our pension funds, and being reinvested in companies that repeat this process because it provides the highest return on that financial capital.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

Imagine if the pension funds and endowments that own much of the equity in our financial services companies demanded that those companies revisit the way mortgages were marketed to those without adequate skills to understand the products they were being sold. Management would have to change the way things were done.

In the end, alchemy, whether it is metallurgical or financial, fails. A base business can not be transformed into a golden business by tricks of accounting or capital structure. The man claiming to be a financial alchemist may become rich. But gullible investors rather than business achievements will usually be the source of his wealth.