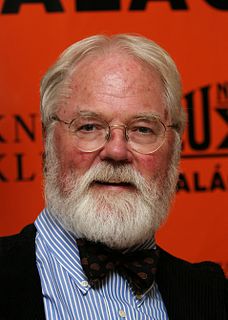

A Quote by Paul Keating

Countries get one chance in history of putting into place a savings retirement scheme on the scale of the Australian superannuation system.

Quote Topics

Related Quotes

Socialist countries throughout the world love to lower retirement ages to make people prematurely dependent on the government. But we should move in the opposite direction. In the long run, indexing retirement to life expectancy will yield enormous revenues to the system, far more than a one-shot increase in the age in the current legislative cycle.