A Quote by Paul Krugman

Close the weak banks and impose serious capital requirements on the strong ones...You see, it may sound hard-hearted, but you cannot keep unsound financial institutions operating simply because they provide jobs.

Related Quotes

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

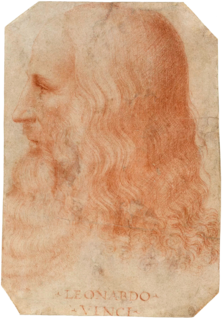

I say that in narrative paintings one should mingle direct contraries close by, because they produce strong contrasts with one another, and all the more so when they are very close together; that is, the ugly next to the beautiful, the big to the small, the old to the young, the strong to the weak; in this way you will vary as much as possible and close by.