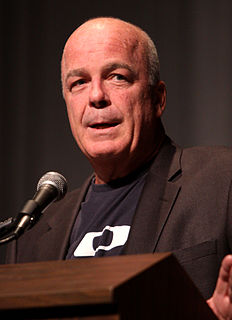

A Quote by Paul Krugman

When stock prices are rising, it's called ''momentum investing''; when they are falling, it's called ''panic.''

Related Quotes

The greatest danger to an adequate old-age security plan is rising prices. A rise of 2% a year in prices would cut the purchasing power of pensions about 45% in 30 years. The greatest danger of rising prices is from wages rising faster than output per man-hour.... Whether the nation succeeds in providing adequate security for retired workers depends in large measure upon the wage policies of trade unions.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

The fact that the laws of physics don't change as if you move in time has physical implications that there's this thing called energy and energy is conserved, and the same thing - and the fact that the laws of physics don't change of you move back and forth in different directions in space implies that there is something called momentum and momentum is conserve and doesn't change as you evolve in time.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.