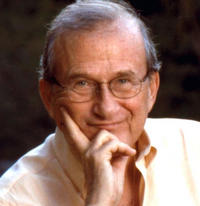

A Quote by Paul Polman

The last few months have seen a welcome race to the top. Consumers have sent companies a clear signal that they do not want their purchasing habits to drive deforestation and companies are responding. Better still, companies are committing to working in partnership with suppliers, governments and NGOs to strengthen forest governance and economic incentives. It can be done and this Declaration signals a real intention to accelerate action.

Quote Topics

Accelerate

Action

Better

Clear

Committing

Companies

Consumers

Declaration

Deforestation

Done

Drive

Economic

Few

Forest

Governance

Governments

Habits

Incentives

Intention

Last

Months

Partnership

Purchasing

Race

Real

Responding

Seen

Sent

Signal

Signals

Still

Strengthen

Suppliers

Top

Want

Welcome

Working

Related Quotes

Companies watch what consumers are doing like a hawk. Just as one letter to a politician can signal an insipient problem, for companies, a trend where people are beginning to switch away from one of their key products to a rival offering on the basis of either claims or real improvements on performance, that's significant.

Many liberals argue that big U.S. companies don't really pay the top corporate rate. While this is sometimes true, it's mainly because, during recessions, companies lose money, and get a tax loss carryforward that temporarily reduces their effective rate. But during economic expansions, when profits rise, companies then do pay the top rate.

I know one thing - very few writers in Southern California get to write what they want to write. We are more or less worker ants, working for either film companies or tv companies or Internet companies. We do a lot of assigned work. Feelings hardly ever enter into it. If they do, they tend to be on a sort of soap opera level.

Today's consumers are eager to become loyal fans of companies that respect purposeful capitalism. They are not opposed to companies making a profit; indeed, they may even be investors in these companies - but at the core, they want more empathic, enlightened corporations that seek a balance between profit and purpose.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.

Many financial and industrial companies have been bailed out with the public's money, but very few of those who had run those companies have been punished for their failures. Yes, the top managers of those companies have lost their jobs - but with a fat pension and mostly with a handsome severance payment.

When we first started our internet company, 'China Pages', in 1995, and we were just making home pages for a lot of Chinese companies. We went to the big owners, the big companies, and they didn't want to do it. We go to state-owned companies, and they didn't want to do it. Only the small and medium companies really want to do it.

I am proud of the fact that the U.K. is an open trading country. I welcome inward investment such as that of Nissan, and the takeover of struggling British companies by foreign companies who turn them around, as in the case of Jaguar Land Rover. I also accept that job losses sometimes have to occur to restore failing companies to health.

Many companies believe incentives, financial incentives, are the answer to every problem or issue. But people are motivated by much more than money. In particular, people like to feel good about themselves and maintain their self-esteem. If companies spent more time working on people's feelings of self-worth, they wouldn't have to try, often unsuccessfully, to bribe people to do work.