A Quote by Paul Samuelson

Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'.

Related Quotes

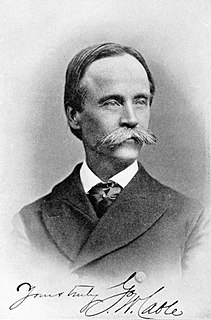

Both ground- rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land are, therefore, perhaps the species of revenue which can best bear to have a peculiar tax imposed upon them.

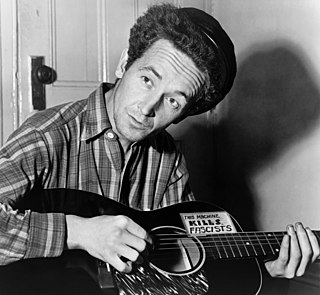

Land taxes is the thing. They got so high that there is no chance to make anything. Not only land but all property tax. You see in the old days, why the only thing they knew how to tax was land, or a house. Well, that condition went along for quite awhile, so even today the whole country tries to run its revenue on taxes on land. They never ask if the land makes anything. "It's land ain't it? Well tax it then."

Economists are almost unanimous in conceding that the land tax has no adverse side effects. ...Landowners ought to look at both sides of the coin. Applying a tax to land values also means removing other taxes. This would so improve the efficiency of a city that land values would go up more than the increase in taxes on land.

A Land Valuation Tax is a levy on the value of the land unimproved by buildings or other enhancement. The method is already used by insurance companies each year when they calculate your home insurance premium - they separate the cost of a total rebuild of the property from the value of the land itself.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

The tax upon land values is the most just and equal of all taxes. It falls only upon those who receive from society a peculiar and valuable benefit, and upon them in proportion to the benefit they receive.It is the taking by the community for the use of the community of that value which is the creation of the community. It is the application of the common property to common uses. When all rent is taken by taxation for the needs of the community, then will the equality ordained by nature be attained.

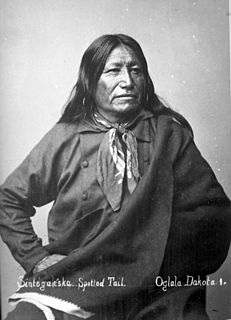

[My father] did get enough money to buy mules. We didn't have tractors, but he bought mules, wagons, cultivators and some farming equipment. As soon as he bought that and decided to rent some land, because it was always better if you rent the land, but as soon as he got the mules and wagons and everything, somebody went to our trough - a white man who didn't live very far from us - and he fed the mules Paris Green, put it in their food and it killed the mules and our cows.

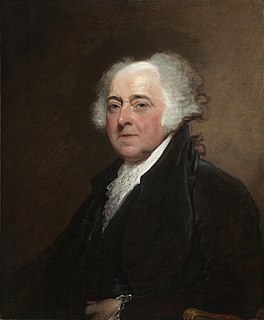

We may... affirm that the balance of power in a society accompanies the balance of property in land. The only possible way, then, of preserving the balance of power on the side of liberty and public virtue is to make the acquisition of land easy to every member of society; to make a division of the land into small quantities, so that the multitude may be possessed of landed estates.