A Quote by Paul Samuelson

Today we see how utterly mistaken was the Milton Friedman notion that a market system can regulate itself... Everyone understands now, on the contrary, that there can be no solution without government.

Related Quotes

I call this the Fundamental Problem of Political Economy. How do we limit the power that idiots have over us? ... [Milton] Friedmans insight is that a market limits the power that others have over us; conversely, limiting the power that others have over us allows us to have markets. Friedman argued that no matter how wise the officials of government may be, market competition does a better job of protecting us from idiots.

I don't think that much change comes from economists. I think it comes more from political realities. Probably the two giants of the 20th century, who actually did shift government policy in the U.S. and around the world, were John Maynard Keynes and Milton Friedman. I don't see anybody in our system who is at that level of influence.

All systems are capitalist. It's just a matter of who owns and controls the capital -- ancient king, dictator, or private individual. We should properly be looking at the contrast between a free market system where individuals have the right to live like kings if they have the ability to earn that right and government control of the market system such as we find today in socialist nations.

Wherever primitive man put up a word, he believed he had made a discovery. How utterly mistaken he really was! He had touched a problem, and while supposing he had solved it, he had created and obstacle to its solution. Now, with every new knowledge we stumble over flint-like and petrified words and, in so doing, break a leg sooner than a word.

The model I like to sort of simplify the notion of what goes on in a market for common stocks is the pari-mutuel system at the racetrack. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and bets and the odds change based on what's bet. That's what happens in the stock market.

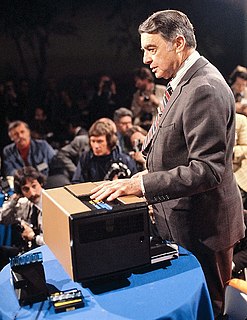

Aladdin in his most intoxicated moments would never have dreamed of asking his [djinn] for [a polaroid] ... It's utterly new in concept and appearance, utilizing an utterly revolutionary flash system, an utterly revolutionary viewing system, utterly revolutionary electronics, and utterly revolutionary film structure.

There's no automatic mechanism in a market system that reconciles the desire to save and the desire to invest. And therefore, the government has to sort of do something or the Federal Reserve, the Fed, or the Central Bank, or whatever, it has to intervene. It has to create enough investment for the economy not to suffer from a fall in aggregate demand. So, if you don't have a balance within the market system itself, then you need an external balance and that's what I think Keynes believed.

We need to ensure that the government agencies that are supposed to be regulating the financial system are actually doing their jobs. We must shrink the federal government and hold it accountable - and to do that, we need a leader who understands how bureaucracies work and how to cut them down to size.