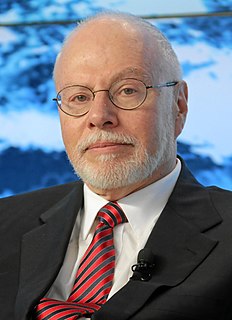

A Quote by Paul Singer

If you want an alternative currency, check out gold. It has stood the test of thousands of years as a store of value and medium of exchange.

Related Quotes

A currency serves three functions: providing a means of payment, a unit of account and a store of value. Gold may be a store of value for wealth, but it is not a means of payment. You cannot pay for your groceries with it. Nor is it a unit of account. Prices of goods and services, and of financial assets, are not denominated in gold terms.

Gold is unique because it has the age-old aspect of being viewed as a store of value. Nevertheless, it’s still a commodity and has no tangible value, and so I would say that gold is a speculation. But because of my fear about the potential debasing of paper money and about paper money not being a store of value, I want some exposure to gold.

I have heard your orators speak on many questions. One among them the so-called vital question of money which is above all things the most coveted commodity but I, as a Jainist, in the name of my countrymen and of my country, would offer you as the medium of the most perfect exchange between us, henceforth and forever, the indestructible, the unchangeable, the universal currency of good will and peace, and this, my brothers and sisters, is a currency that is not interchangeable with silver and gold, it is a currency of the heart, of the good life, of the highest estate on the earth.

Most governments, not all of them, but most, certainly don't want their citizens using gold. They want them in the currency that they are creating. When they are debasing money, or printing money, they are spending it and they want it to have as much value as possible when they originally spend it. Of course once they spend it, it will lose value for them and everyone else that holds it. But they need demand for their currency. They need as many people as possible holding it and transacting it. The more people that use gold, the harder it makes it.

That day the U.S. announced that the dollar would be devalued by 10 percent. By switching the yen to a floating exchange rate, the Japanese currency appreciated, and a sufficient realignment in exchange rates was realized. Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

The available supply of gold and silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money intrinsic value that may come into use.

Gold has intrinsic value. The problem with the dollar is it has no intrinsic value. And if the Federal Reserve is going to spend trillions of them to buy up all these bad mortgages and all other kinds of bad debt, the dollar is going to lose all of its value. Gold will store its value, and you'll always be able to buy more food with your gold.

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.