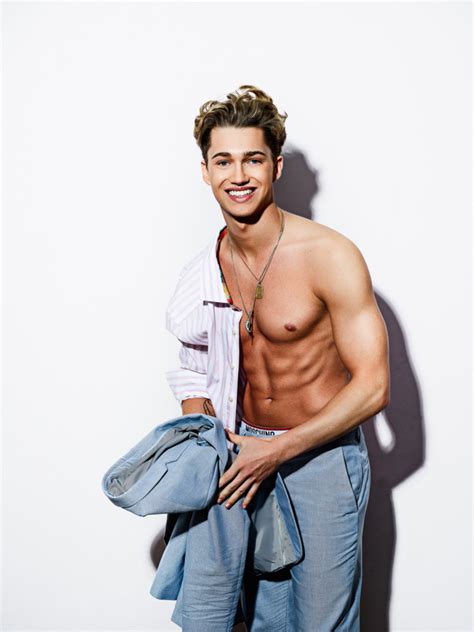

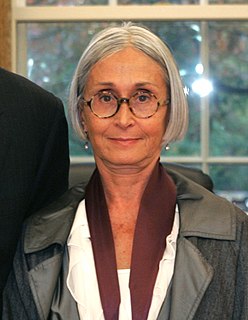

A Quote by Paul Taylor

I want to build a studio in my backyard. The interest rates are low now, so who knows

Related Quotes

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

Despite a lingering low inventory and increasing prices, consumers still have the confidence to purchase a home. More and more people recognize the many opportunities in this market and the significant value of low interest rates. As job creation and wages continue to improve, many more first-time buyers are now making the decision to become homeowners.