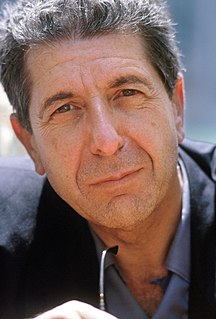

A Quote by Peter Cundill

The difference between the price we pay for a stock and its liquidation value gives us a margin of safety. This kind of investing is one of the most effective ways of achieving good long term results.

Related Quotes

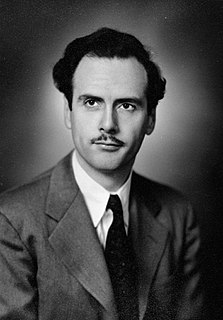

Edge also implies what Ben Graham....called a margin of safety. You have a margin of safety when you buy an asset at a price that is substantially less than its value. As Graham noted, the margin of safety 'is available for absorbing the effect of miscalculations or worse than average luck.' ...Graham expands, "The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

[W]e think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value -- in the hope that it can soon be sold for a still-higher price -- should be labeled speculation (which is neither illegal, immoral nor -- in our view -- financially fattening).

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

Value investing doesn't always work. The market doesn't always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn't work. And that is a very good thing. The fact that our value approach doesn't work over periods of time is precisely the reason why it continues to work over the long term.

Most unmarried people have no idea what it takes to make a marriage work; they grossly underestimate the price people have to pay to build long-term, mutually satisfying relationships. And they fail to understand that the only people with the strength to pay that price are those who have plumbed the depths of their relationship with God, and have dealt with their own brokenness.