A Quote by Peter Cundill

The company must be profitable. Preferably it will have increased its earnings for the past five years and there will have been no deficits over that period.

Related Quotes

The history of the past fifty years, and longer, indicates that a diversified holding of representative common stocks will prove more profitable over a stretch of years than a bond portfolio, with one important provisio that the shares must be purchased at reasonable market levels, that is, levels that are reasonable in the light of fairly well-defined standards derived from past experience.

I think there's an awful lot of twaddle and bullshit on EVA. The whole game is to turn retained earnings into more earnings. EVA has ideas about cost of capital that make no sense. Of course, if a company generates high returns on capital and can maintain this over time, it will do well. But the mental system as a whole does not work.

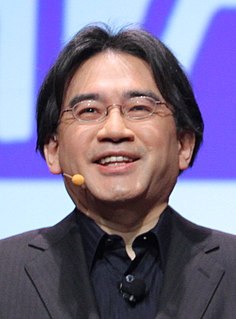

The profitable part of the online business is very likely several years away. Entering the business because it's the hot topic of the day doesn't make a profitable business nor satisfied customers. That's why it will be a part of Nintendo's strategy, not the mainstay, as other companies are attempting to do. There still are too many barriers for any company to greatly depend on it.