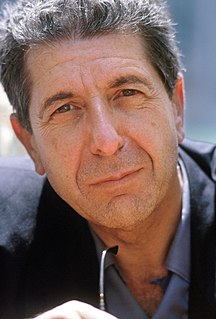

A Quote by Peter Cundill

There will be losing years; but if the art of making money is not to lose it, then there should not be substantial losses.

Related Quotes

If you buy all the stocks selling at or below two times earnings, you will lose money on half of them because instead of making profits they will actually lose money, but you will only lose a dollar or so a share at most. Then others will be mediocre performers. But the remaining big winners will go up and produce fabulous results and also ensure a good overall result.

It is true that when we take chances, we stand to lose. But it is also true that we will never win anything if we never even enter the game. Lucky people are aware of the possibility of losing, and indeed they may lose often. But since the chances they take are small, the losses tend to be small. By being willing to accept small losses they put themselves in position to make large gains.

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don't cut their losses short.

The money has to be deferred with what they call "clawback," which means they can get it back if I lose it all. So that guy making ten million a year selling credit default swaps, if we're going to keep five million of it in escrow for ten years, and with the right to go back and get it, if he starts losing money, then we're going to give people the right incentives not too take so much risk.

My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks. The emotional burden of trading is substantial; on any given day, I could lose millions of dollars. If you personalize these losses, you can’t trade.

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

The real Art of Peace is not to sacrifice a single one of your warriors to defeat an enemy. Vanquish your foes by always keeping yourself in a safe and unassailable position; then no one will suffer any losses. The Way of a Warrior, the Art of Politics, is to stop trouble before it starts. It consists in defeating your adversaries spiritually by making them realize the folly of their actions. The Way of a Warrior is to establish harmony.

Nuclear is the single greatest threat. Just to go down the list, we defend Japan, we defend Germany, we defend South Korea, we defend Saudi Arabia, we defend countries. They do not pay us. But they should be paying us, because we are providing tremendous service and we're losing a fortune. That's why we're losing - we're losing - we lose on everything. I say, who makes these - we lose on everything.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.