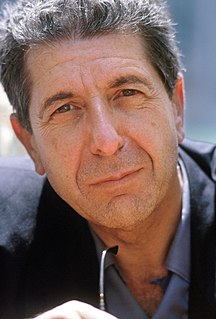

A Quote by Peter Cundill

Just as many smart people fail in the investment business as stupid ones. Intellectually active people are particularly attracted to elegant concepts, which can have the effect of distracting them from the simpler, more fundamental truths.

Related Quotes

When we were young, there weren't very many smart people in the investment world. You should have seen the people in the bank trust departments. Now, there are armies of smart people at private investment funds, etc . If there were a crisis now, there would be a lot more people with a lot of money ready to take advantage.

This whole issue of limits to growth, which provides a psychological, as well as a physical, cap on potential expansion of activity and awareness, has had a very depressing effect on many people.... I don't for a moment think that there's any concept which anyone's working with now which will be followed as a straightforward scenario. But the idea embodied in concepts such as space colonization or space industrialization, or availability of nonterrestrial resources, is fundamental, and it will change the way in which people look at the future.

The concept of 'measurement' becomes so fuzzy on reflection that it is quite surprising to have it appearing in physical theory at the most fundamental level ... does not any analysis of measurement require concepts more fundamental than measurement? And should not the fundamental theory be about these more fundamental concepts?

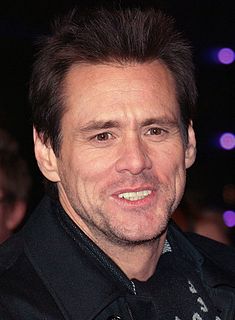

I have a name for people who went to the extreme efficient market theory-which is "bonkers". It was an intellectually consistent theory that enabled them to do pretty mathematics. So I understand its seductiveness to people with large mathematical gifts. It just had a difficulty in that the fundamental assumption did not tie properly to reality.

God is one among several hypotheses to account for the phenomena of human destiny, and it is now proving to be an inadequate hypothesis. To a great many people, including myself, this realization is a great relief, both intellectually and morally. It frees us to explore the real phenomena for which the God hypothesis seeks to account, to define them more accurately, and to work for a more satisfying set of concepts.

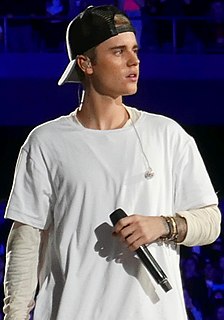

The kind of people that all teams need are people who are humble, hungry, and smart: humble being little ego, focusing more on their teammates than on themselves. Hungry, meaning they have a strong work ethic, are determined to get things done, and contribute any way they can. Smart, meaning not intellectually smart but inner personally smart.

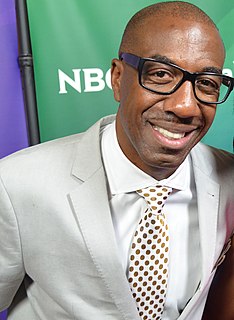

Successful people just don't let failure define them or keep them from doing what they want to do. For example, I'd have people come up to me after my shows, and they'd say they want to do stand-up but are scared they're going to fail. I'd tell them, "You are going to fail, and anyone who is success has powered through many, many failures."

There's book smart, there is street smart, there's relationship smart, there's too many different kinds of smarts to know all of them. Everybody doesn't know every kind of smart. There's money smart, there's movie smart, there's computer smart. There's just too many different kinds of smarts for people to know all the smarts.

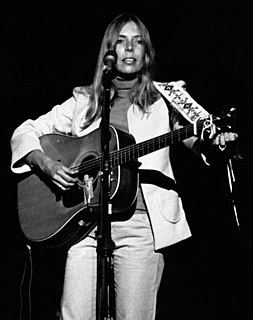

Alexander Liberman was very smart, very elegant. At the end, he didn't have much patience with me because I was a young, anxious, nervous photographer. I worried that I was copying too many other people. And he said, "It's all right to copy people, as long as the people you copy are good and you copy them well."

One of the most important analytic tools when assessing an investment is an intellectually advantaged disparate view. This includes knowing more and perceiving the situation better than others do. It is also critical to have a keen understanding of what the market expectations for any investment truly are. Thus, the process by which a disparate perception, when correct, becomes consensus should lead to meaningful profit. Understanding market expectation is at least as important as, and often different from fundamental knowledge.

Complexity has and will maintain a strong fascination for many people. It is true that we live in a complex world and strive to solve inherently complex problems, which often do require complex mechanisms. However, this should not diminish our desire for elegant solutions, which convince by their clarity and effectiveness. Simple, elegant solutions are more effective, but they are harder to find than complex ones, and they require more time, which we too often believe to be unaffordable