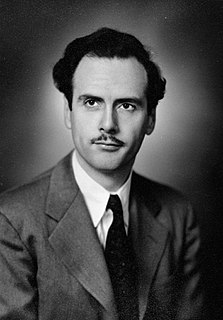

A Quote by Peter Cundill

Protect the downside. Worry about the margin of safety.

Related Quotes

Edge also implies what Ben Graham....called a margin of safety. You have a margin of safety when you buy an asset at a price that is substantially less than its value. As Graham noted, the margin of safety 'is available for absorbing the effect of miscalculations or worse than average luck.' ...Graham expands, "The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

We live in a fantastically wealthy country. We don't have to worry about food. We don't have to worry about clothing. We don't have to worry about our safety. It's very easy for me to be an environmentalist. It's very easy for me to care about making sure that we protect the forests and the whales, and all that stuff.

If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger margin of safety you'd need. If you're driving a truck across a bridge that says it holds 10,000 pounds and you've got a 9,800 pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it's over the Grand Canyon, you may feel you want a little larger margin of safety.

We're wealthy people. We're sitting here in New York, Washington. We live in a fantastically wealthy country. We don't have to worry about food. We don't have to worry about clothing. We wore the same shirt. We don't have to worry about our safety. It's very easy for us to be environmentalists. It's very easy for me to be an environmentalist. It's very easy for me to care about making sure that we protect the forests and the whales, and all that stuff. It's very hard for someone who makes $1,000 a year or some who makes less than $1 a day to care about the environment.

So one way to create an attractive risk/reward situation is to limit downside risk severely by investing in situations that have a large margin of safety. The upside, while still difficult to quantify, will usually take care of itself. In other words, look down, not up, when making your initial investment decision. If you don’t lose money, most of the remaining alternatives are good ones.

Let me have my tax money go for my protection and not for my prosecution. Let my tax money go for the protection of me. Protect my home, protect my streets, protect my car, protect my life, protect my property...worry about becoming a human being and not about how you can prevent others from enjoying their lives because of your own inability to adjust to life.

Even with a margin of safety in the investor's favor, an individual security may work out badly. For the margin guarantees only that he has a better chance for profit than for loss - not that loss is impossible. But as the number of such commitments is increased the more certain does it become that the aggregate of the profits will exceed the aggregate of the losses.