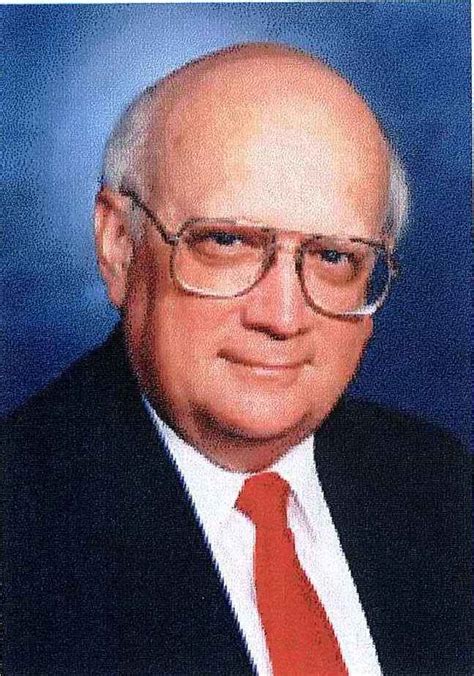

A Quote by Peter Diamandis

The Department of Energy made an investment that failed, and it got raked over the coals for that failed investment. This is ridiculous. The fact of the matter is, the government should be making a lot of risky investments, the majority of which are likely to fail.

Quote Topics

Related Quotes

Unlike return, however, risk is no more quantifiable at the end of an investment that it was at its beginning. Risk simply cannot be described by a single number. Intuitively we understand that risk varies from investment to investment: a government bond is not as risky as the stock of a high-technology company. But investments do not provide information about their risks the way food packages provide nutritional data.

My rather puritanical view is that any investment manager, whether operating as broker, investment counselor of a trust department, investment company, etc., should be willing to state unequivocally what he is going to attempt to accomplish and how he proposes to measure the extent to which he gets the job done.

There's a long list of investments that governments could and should be making. There is strengthening infrastructure, such as transport and communications; there is investment in education; there is investment in families, particularly putting measures in place that free women from having to make the choice between raising a family and work.

Rather, risk is a perception in each investor's mind that results from analysis of the probability and amount of potential loss from an investment. If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky. But if the well is a gusher, the bond matures on schedule, and the stock rallies strongly, can we say they weren't risky when the investment after it is concluded than was known when it was made.

In many parts of our country, geography and population density can make it difficult to attract private investment. These communities depend on federal investments to maintain and upgrade their transportation systems and stay competitive. And we know that it's an investment worth making. Because when rural America succeeds, we all do.

I do believe that India needs a lot more foreign direct investment than we've got, and we should have the ambition to move in the same league many other countries in our neighborhood are moving. We may not be able to reach where the Chinese are today, but there is no reason why we should not think big about the role of foreign direct investment, particularly in the areas relating to infrastructure, where our needs for investment are very large. We need new initiatives, management skills, and I do believe that direct foreign investment can play a very important role.