A Quote by Peter Diamandis

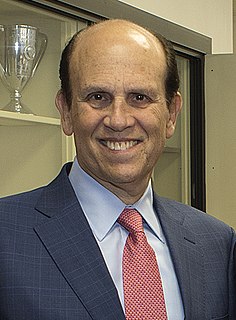

A dapper Canadian in his mid-fifties, Rob McEwen bought the disparate collection of gold mining companies known as Goldcorp in 1989. A decade later, he'd unified those companies and was ready for expansion - a process he wanted to start by building a new refinery.

Related Quotes

Today, a large part of Peru's revenues come from mining. Many big mining companies only pay income tax, but they extract minerals, they pollute the water. They don't give any form of compensation to the regions where those minerals are extracted and where they do the damage, forcing the state to help those regions. What my party Gana Peru is stating is that the mining companies will have to pay that compensation. That is called a royalty.

Small and mid-sized companies in this country historically have been responsible for creating the overwhelming majority of new jobs in the private sector. One of the most-common misconceptions about our private enterprise system is that large companies, such as the Fortune 500, are integral to the process of job creation in this country. The truth is quite the opposite.

If Canadian companies want to sell products to the E.U., they have to prove those products conform with E.U. product safety, health and environmental rules. This involves extra bureaucracy, controls and paperwork. If the U.K. had a Canada-style deal with the E.U., U.K. companies would have to do the same.

A research group found that 56 percent of major companies surveyed in the late '80s agreed that 'employees who are loyal to the company and further its business goals deserve an assurance of continued employment.' A decade later, only 6 percent agreed. It was in the '90s that companies started weeding people out as a form of cost reduction.

Many financial and industrial companies have been bailed out with the public's money, but very few of those who had run those companies have been punished for their failures. Yes, the top managers of those companies have lost their jobs - but with a fat pension and mostly with a handsome severance payment.

European and American companies companies do create jobs for some people but what they're mainly going to do is make an already wealthy elite wealthier, and increase its greed and strong desire to hang on to power. So immediately and in the long run, these companies - harm the democratic process a great deal.

There are black companies that are very active in the economy, that are growing and not on the basis of mergers and acquisitions, but because of putting new money into their particular companies and, therefore, their particular sectors. Indeed, if they didn't do that, they would collapse as companies.

Companies that acquire startups for their intellectual property, teams, or product lines are acquiring startups that are searching for a business model. If they acquire later stage companies who already have users/customers and/or a predictable revenue stream, they are acquiring companies that are executing.

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.