A Quote by Peter Lynch

What makes stocks valuable in the long run isn't the market. It's the profitability of the shares in the companies you own. As corporate profits increase, corporations become more valuable and sooner or later, their shares will sell for a higher price.

Related Quotes

It's no longer terribly sexy to own shares in certain companies; it used to be that being a shareholder in a corporation would connect you with it. The result is that people really want to invest in valuable things, and contemporary art has become a very stable material value with great growth potential.

When Wal-Mart brings water down to the Katrina victims, it's not doing that to be nice; it's doing it to make larger profits and to increase the value of its shares. If its actions are not accomplishing those objectives, the shareholders can sue the executives, and sue them successfully, because it is illegal for them to act on behalf of any other reason than increasing the value of their shares. There is nothing wrong with that. That is the way that they were created and the way we want them to function to increase prosperity in the market.

Not yet have I found any better method to prosper during the future financial chaos, which is likely to last many years, than to keep your net worth in shares of those corporations that have proven to have the widest profit margins and the most rapidly increasing profits. Earning power is likely to continue to be valuable, especially if diversified among many nations.

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

I was left £50 when I was ten by a fairly distant cousin, which my father invested in GEC shares on my behalf. I became interested in the market and was given some more shares by my father, which is when I began looking to see how the shares were performing and learning how to read company reports, balance sheets, and so on in order to gauge that.

Christ has something in common with all creatures. With the stone he shares existence, with the plants he shares life, with the animals he shares sensation, and with the angels he shares intelligence. Thus all things are transformed in Christ since in the fullness of his nature he embraces some part of every creature.

I think the American people should see that the corporations abandoned them long ago. That people will have to build their own economies and rebuild democracy as a living democracy. The corporations belong to no land, no country, no people. They have no loyalty to anything apart from the base-line - their profits. And the profits today are on an unimaginable scale; it has become illegitimate, criminal profit - profits extracted at the cost of life.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

Are you going to divest in the banks and pension funds? Plenty of people are willing to invest in stock of those companies. You can argue that when a lot of people divest, it makes the stock price artificially low, which makes their price-to-earnings ratio more favorable, which makes it a better investment for the people who don't give a damn - - and is it really going to change corporate behavior? It begins to create a climate of antagonistic opinion, the result might be that the corporate executives will retreat even more into their own selfjustifying narratives.

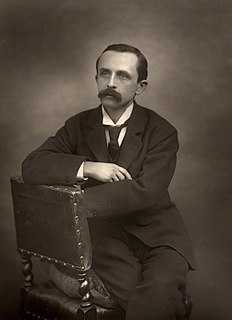

Mr. Darling used to boast to Wendy that her mother not only loved him but respected him. He was one of those deep ones who know about stocks and shares. Of course no one really knows, but he quite seemed to know, and he often said stocks were up and shares were down in a way that would have made any woman respect him.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.