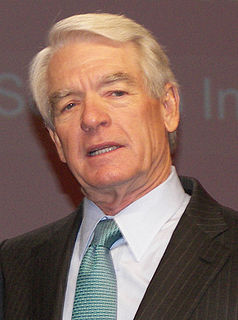

A Quote by Peter Lynch

Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock and it goes down does not mean you are wrong.

Related Quotes

If the stock market does go through a crisis of confidence, which I think clearly will happen one of these days, no one can predict just like you couldn't the dot com crash or the Lehman crash, but when it goes down it will go down by thousands of points because everyone will panic. No one owns this market today because they believe there's a huge sunny future for the United States economy. They're buying because they think the Fed can keep the thing pumped up, the bubble expanding.

That goes back to 1932, although it was really implemented in '33 under Jesse Jones, and it invested in mostly banks initially and preferred stock and that sort of thing. So there are two things needed in the system, the one that's needed overwhelmingly is liquidity. I mean, when people are trying to [unintelligible], there has to be somebody there to buy.

My personality, when tasked with creating meals, goes something like this: Is there a way we can make this more difficult? Because let's do that. I don't mean to complicate things. It's just - why buy pre-packaged potato salad when you can spend your morning boiling potatoes and flipping out because there's no dill in the house?

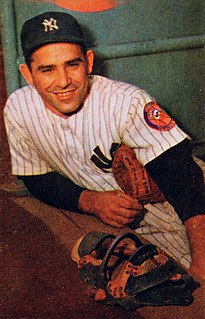

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.