A Quote by Peter Lynch

A price drop in a good stock is only a tragedy if you sell at that price and never buy more. To me, a price drop is an opportunity to load up on bargains from among your worst performers and your laggards that show promise. If you can't convince yourself "When I'm down 25 percent, I'm a buyer" and banish forever the fatal thought "When I'm down 25 percent, I'm a seller," then you'll never make a decent profit in stocks.

Related Quotes

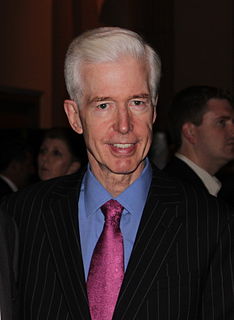

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.

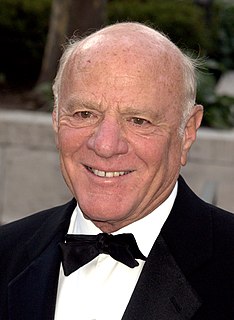

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

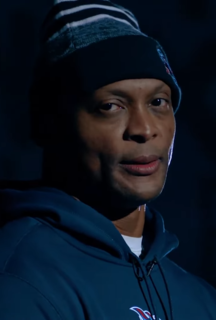

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

See the investment world as an ocean and buy where you get the most value for your money. Right now the value is in non-callable bonds. Most bonds are callable so when they start going up in price, the debtor calls them away from you. But the non-callable bonds, especially those non-callable for 25-30 years, can go way up in price if interest rates go way down.

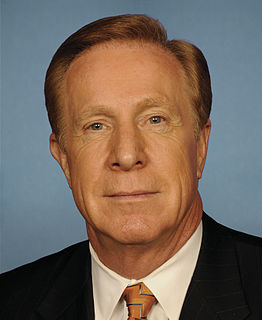

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K.