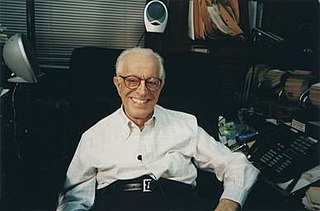

A Quote by Peter Lynch

Hold no more stocks than you can remain informed on.

Related Quotes

When I stand on my special-issue "Intelligent Investor" ladder and peer out over the frenzied crowd, I see very few others doing the same. Many stocks remain overvalued, and speculative excess - both on the upside and on the downside - is embedded in the frenzy around stocks of all stripes. And yes, I am talking about March 2001, not March 2000.