A Quote by Peter Lynch

I like to buy a company any fool can manage because eventually one will.

Related Quotes

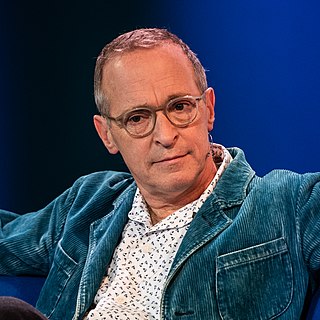

I would still be reading out loud. I think that if you are any kind of an artist, then validation is just sort of... it can be a result, but you're going to do the work anyway. Because you're just wired that way. It's so engrained, it's such a part of your personality that you don't just stop doing it. Eventually I'll retire on some level, eventually no one will want to buy my books or a ticket to see me read, it's inevitable that's going to happe

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

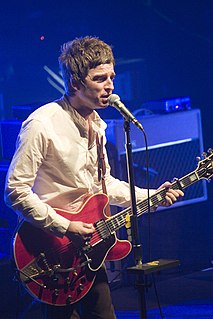

Be willing to use yourself to get out there and put the company on the market. If you have to make a fool of yourself, make a fool of yourself, but make sure that you end up on the front pages, not the back pages. In time, it's possible that your company will stand out from the crowd, and you'll be successful.

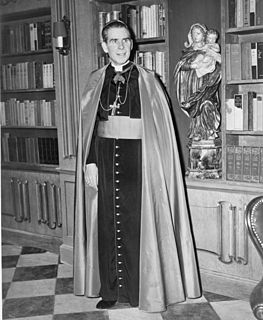

Monopolistic capitalism is to blame for this; it sunders the right to own property from responsibility that owning property involves. Those who own only a few stocks have no practical control of any industry. They vote by postcard proxy, but they have rarely even seen "their" company. The two elements which ought to be inextricably joined in any true conception of private property - ownership and responsibility - are separated. Those who own do not manage; those who manage; those who manage and work do not control or own.