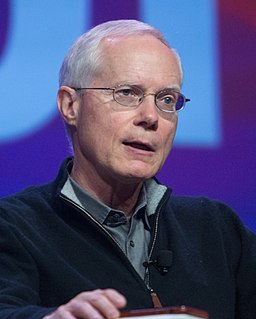

A Quote by Peter Lynch

Equity mutual funds are the perfect solution for people who want to own stocks without doing their own research.

Related Quotes

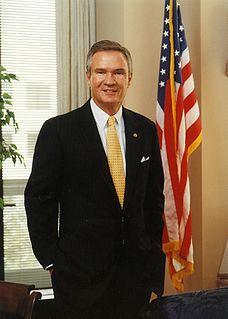

Of course, giving is deeply emotional. But supplementing emotion with research makes it more likely that a gift can have a bigger impact. It's like any investment. After all, you wouldn't put funds into stocks or bonds without understanding the potential return. Why wouldn't you do the same when investing in society?