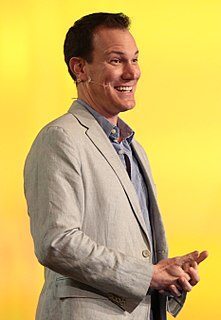

A Quote by Peter Lynch

Thousands of experts study overbought indicators, oversold indicators,

head-and-shoulder patterns, put-call ratios, the Fed's policy on money supply, foreign investment, the movement of the constellations through the heavens, and the moss on oak trees, and they can't predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.

Related Quotes

Most problems, decisions, and performances are multidimensional, but somehow the results have to be reduced to a few key indicators which are to be institutionally rewarded or penalized... The need to reduce the indicators to a manageable few is based not only on the need to conserve the time (and sanity) of those who assign rewards and penalties, but also to provide those subject to these incentives with some objective indication of what their performance is expected to be and how it will be judged... key indicators can never tell the whole story.

How old are you? If your first reflex is to reply with your chronological age, the number on your birth certificate, you are only one-third correct. There are actually two additional, and more important, indicators of age. And the exciting news is that it is within your power to adjust both of these other "age indicators" and truly grow younger and live longer.

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.

There are only patterns, patterns on top of patterns, patterns that affect other patterns. Patterns hidden by patterns. Patterns within patterns. If you watch close, history does nothing but repeat itself. What we call chaos is just patterns we haven't recognized. What we call random is just patterns we can't decipher. what we can't understand we call nonsense. What we can't read we call gibberish. There is no free will. There are no variables.

Actually, one of the better indicators historically of how well the stock market will do is just a Gallup poll, when you ask Americans if you think it's a good time to invest in stocks, except it goes the opposite direction of what you would expect. When the markets going up, it in fact makes it more prone toward decline.

Who would you trust right now? Which bank would you trust? Which investment would you trust? Do you really want to put your money; do you want to suffer more of these losses that we just had? You know, these volatility that we see is just unexplainable by any rational standards. Nobody has any clue about how to explain this, and nobody wants to experience that. So, we hold more money back, we don't necessarily want to invest in the market and by default, people are saving more.

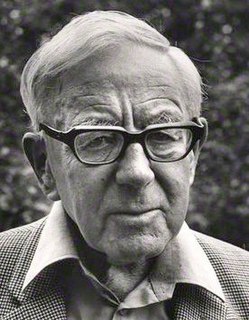

We are apt to say that a foreign policy is successful only when the country, or at any rate the governing class, is united behind it. In reality, every line of policy is repudiated by a section, often by an influential section, of the country concerned. A foreign minister who waited until everyone agreed with him would have no foreign policy at all.