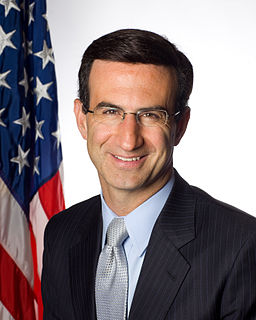

A Quote by Peter Orszag

Total borrowing has imploded. Private borrowing has collapsed. And, in effect, the Treasury Department is the last borrower left standing.

Related Quotes

While conventional wisdom has traditionally sided against borrowing from retirement savings, sentiment has shifted toward borrowing from one's own assets with the realization that other forms of credit come at a much higher cost and often are not even available to borrowers with limited means and urgent needs.