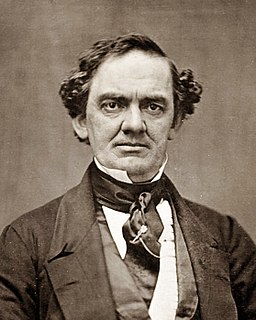

A Quote by Peter Schiff

Once the dollar begins to collapse beneath the weight of all this new deficit spending, accumulation of contingency liabilities and the socialization of our economy, commodity prices and interest rates will head skyward.

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

A penny here, and a dollar there, placed at interest, goes on accumulating, and in this way the desired result is attained. It requires some training, perhaps, to accomplish this economy, but when once used to it, you will find there is more satisfaction in rational saving than in irrational spending.

I've never been able to get it straight about what these people who are worried about the trade deficit are worried about. When they say that we're buying too much from overseas, that we're sending too many dollars overseas to get all these goods and services they got, they're saying that the American dollar is too strong and that is hurting our economy. And the result of this will be that the American dollar will get too weak, and that will hurt our economy.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

If the U.S. Government was a company, the deficit would be $5 trillion because they would have to account by general accepted accounting principles. But actually they encourage government spending, reckless government spending, because the government can issue Treasury bills at extremely low interest rates.

In the budget, the president will call for a five-year freeze on discretionary spending other than for national security. This will reduce the deficit by more than $400 billion over the next decade and bring this category of spending to the lowest share of our economy since Dwight Eisenhower was president.

When you look at February's (2011) deficit spending alone, and the fact that it was larger than what our total deficit spending was in 2007, the proposals that the Senate is sending us simply are ridiculous, because it's not even a solution. It doesn't address the amount of spending that we have in a week's time. We need to get serious.