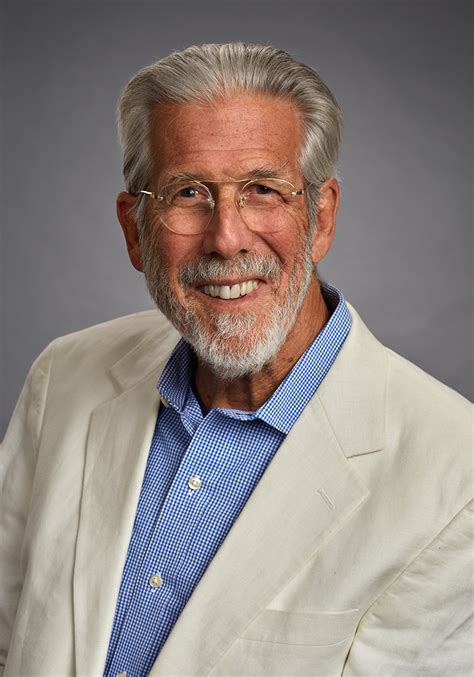

A Quote by Peter Schiff

We're on a collision course for disaster. All we can do, all your viewers can do is brace for impactBuy gold. Buy silver Get as far away as you can from U.S. currency and the U.S. economy.

Related Quotes

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

So if you think America's politicians and citizens are willing to make the changes necessary to strengthen the U.S. dollar, then don't buy silver. But if you're like me and don't expect us, as a nation, to take our medicine, then short the dollar - and the way you short the currency is by going long on gold and silver.

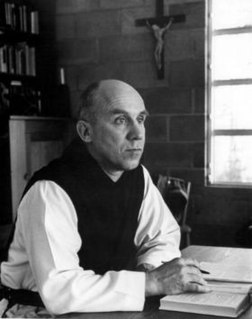

I have heard your orators speak on many questions. One among them the so-called vital question of money which is above all things the most coveted commodity but I, as a Jainist, in the name of my countrymen and of my country, would offer you as the medium of the most perfect exchange between us, henceforth and forever, the indestructible, the unchangeable, the universal currency of good will and peace, and this, my brothers and sisters, is a currency that is not interchangeable with silver and gold, it is a currency of the heart, of the good life, of the highest estate on the earth.

America really started to die when the Federal Reserve was founded, and it really started to die in 1971 when the gold backing was taken away from the dollar, and this currency with Ben Bernanke just printing up or counterfeiting as much money as he wants and destroying the economy is really destroying the economy.

The available supply of gold and silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money intrinsic value that may come into use.