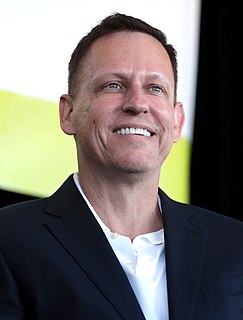

A Quote by Peter Thiel

I think we have a bubble in the US in government bonds, because of the quantitative easing and the negative real interest rates, and to some extent, that increases asset values across the board, including in startups.

Related Quotes

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

If you let interest rates be freed, be set by the free market, they would rise dramatically. There would be a lot of broken furniture on Wall Street. It needs to be broken. The back of the speculative bubble would be broken and we could slowly heal the financial system. That's what I think we need to do but it's never going to happen because there's trillions of asset values dependent on the Fed continuing to suppress, repress interest rates and shovel $85 billion a month of liquidity into the market.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.

I think the issue that millennials have is that the return on asset classes such as bonds, cash, are so low now compared to the historical levels that it's very difficult for them to save enough to be able to retire comfortably. If interest rates do trend back upwards, it may be less of a problem going forward.

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.

I've always believed that a speculative bubble need not lead to a recession, as long as interest rates are cut quickly enough to stimulate alternative investments. But I had to face the fact that speculative bubbles usually are followed by recessions. My excuse has been that this was because the policy makers moved too slowly - that central banks were typically too slow to cut interest rates in the face of a burst bubble, giving the downturn time to build up a lot of momentum.

We live in a global market and money's fungible and hedge fund private equity is looking for momentum plays, and there ain't no momentum plays in bonds, right? When the interest rates were spiking up or down, well they never really spike down they do spike up though. Something's got to happen, there's got to be motion, the dice has to be rolling on the board, and if it's not then they're not going to play because they're not going to get the adrenaline rush from looking at... you know, money markets fund interest rates or bond interests or whatever. It's got to be sexy.

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.