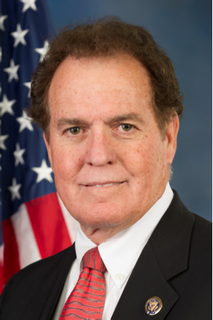

A Quote by Phil Gingrey

Spending on largely ineffective programs - although well intentioned - is a detriment to fostering real job growth.

Related Quotes

Does it sound outrageous to you that military spending for fiscal year 2000 will be almost $290 billion and all other domestic discretionary spending, such as education, job training, housing, Amtrak, medical research, environment, Head Start and many other worthwhile programs will total $246 billion, the biggest disparity in modern times ?

In response to the recession, the Obama administration chose to emphasize costly, short-term fixes - ineffective stimulus programs, myriad housing programs that went nowhere, and a rush to invest in 'green' companies. As a consequence, uncertainty over policy - particularly over tax and regulatory policy - slowed the recovery.